OpuVest is our unique Investment Division available through Personal Financial Group. OpuVest’s Investment Strategist, Don Clark, and his investment team works closely with fund companies, portfolio managers, analysts and research strategists to build diversified portfolios to meet your long-term goals and objectives.

Your portfolio is like a thumbprint - it's never going to be the exact same as anyone else's. The markets, your investment attitude and risk tolerance, and your financial needs evolve over time. OpuVest is designed to be able to seemlessly change with you as you work towards financial independence.

OpuVest Model Wealth Portfolio (MWP) OpuVest Guided Wealth Portfolios (GWP)

TOGETHER, WE OFFER THE PROFESSIONAL STRATEGIES TO HELP YOU WORK TOWARD YOUR GOALS

A Comprehensive Approach: Clients Get a Fiduciary—Plus More

With OpuVest, Your Financial Advisor is your fiduciary, meaning they’ll be providing you with a thoughtful, comprehensive approach to portfolio management and considering the many aspects of your financial situation and goals before making recommendations or adjustments.

- Along with being your fiduciary, Your Advisor will have other team members who also have a fiduciary responsibility and are required to make changes and decisions that are best for your stated objectives.

- In addition, OpuVest Portfolios will help Your Advisor align your investment strategy with your vision for the future and feelings about risk, savings and wealth.

- With Your Advisors assistance and input, your OpuVest Investment Strategist can help you work toward realizing your goals through an asset management strategy that provides a disciplined investment process backed by turnkey resources

Our Investment Team

No one person, company, or even team has complete investment knowledge. The best of the best have partners or teams who help diversify their knowledge and expertise to help develop stronger solutions.

Behind our Investment Strategist is his local support team and staff. Don also has the resources and support of teams with LPL, Blackrock, FutureAdvisor, American Century, DFA, Fidelity, JP Morgan, Avantis and other Analysts that enable him to work more efficiently and effectively for you.

By utilizing proven-effective platforms to custody your assets held at LPL Financial, we bring experience and technology together to help you reach your financial goals. We manage portfolios across various platforms so that our Advisors have the tools to best meet your investment needs.

Our Philosophy

At Personal Financial Group (PFG), we believe in building investment portfolios to meet the individual needs of our clients. Whether it is a short-term need or long-term need, we create Growth-Oriented Portfolios, portfolios focused on Capital Preservation and everything in between. Our OpuVest Team includes several Certified Financial PlannersTM who understand that in order to meet your needs, their portfolios need to be built with your unique circumstances in mind:

- These portfolios are only one part of a clients financial picture.

- They can easily adapt to changes in the market and the economy.

- Our models are built using mutual funds and ETFs that maximize performance, cost effectiveness and tax efficiency.

- Different clients need different types of portfolios.

- Having various platforms available can help meet the individual needs of clients based on their situation.

INTELLIGENT PORTFOLIO MANAGEMENT

Your Investment Strategist can quickly create, manage, and track models for each investment objective or client group, while contributing to offer our clients a unique and valuable perspective. They can easily move between among models of different investment objectives, make fund adjustments and rebalance regularly.

assignment_ind

Personalized Portfolio

Your portfolio is as unique as you are.

bar_chart

Actively Optimized

Our team works to actively optimize and re-balance your portfolio so that it remains aligned with your investment strategy.

mediation

Simplified Money Management

Your portfolio made simple and convenient. We streamline to make process to make it easy to understand.

We believe centrally managed platforms like those used through OpuVest are the future of financial advising, because they don't rely on just one advisor to know everything. It makes a lot more sense to have a team approach. Most importantly, they allow your money to be managed efficiently so that you Advisor and their Team can spend more time focusing on YOU!

Get Started

Below are hypothetical examples of just a few of our portfolios. Hover over each graph to learn more!

(Keep in mind that our portfolios evolve based on markets and research, what you see below may not be an exact representation of our current models. To determine what best suits your needs, reach out to your Financial Advisor today!)

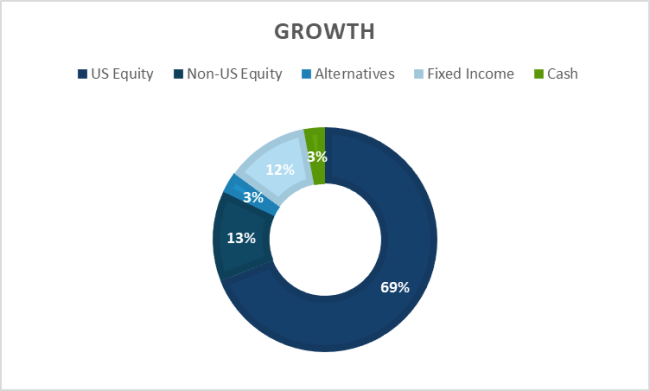

Growth Portfolio

Our Growth Model is for clients looking to maximize growth potential, perform similar to industry benchmarks, have a higher tolerance for risk, and have a 15+ year time horizon for the monies invested in this account. This model is focused on providing growth over the long term and is not income oriented. It is suited best for long term Retirement Accounts. Emphasis is placed primarily on US Equities with up to 25%-30% exposure to Fixed Income, International Equity, Alternatives and Cash.

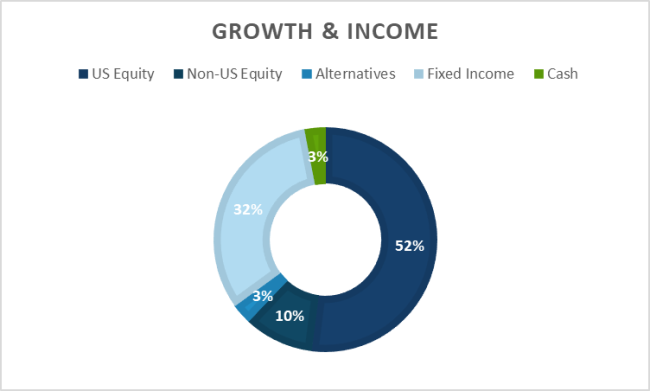

Growth & Income Portfolio

Our Growth & Income Model is for clients who are looking to get a mix of both long-term growth and short-term income. It is suited for clients with a 10+ year time horizon and is for clients with slightly less risk tolerance than our Growth Model would require. Emphasis is placed primarily on US Equities with up to 40%-45% exposure to Global Fixed Income, International Equity, Alternatives and Cash.

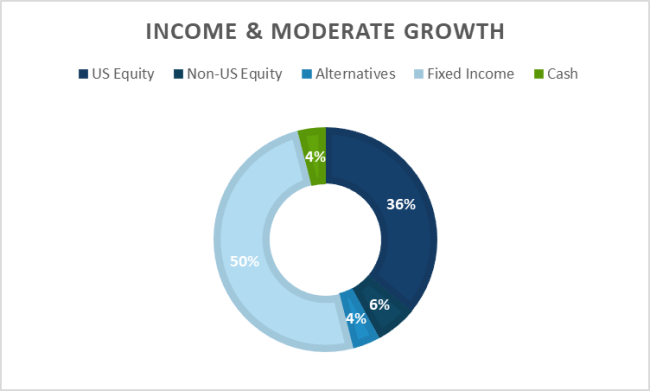

Income & Moderate Growth Portfolio

Our Income & Moderate Growth Model is for clients who are looking to balance out their opportunity for a moderate level of growth and while also generating income and have up to 5-10 years of time horizon. This model is for clients with mid-low risk tolerance levels and are more focused on preserving their capital with the opportunity of income than major growth. Emphasis is balanced between Global Allocation of Bonds and US Equities with up to 15% International Equity, Alternatives and Cash.

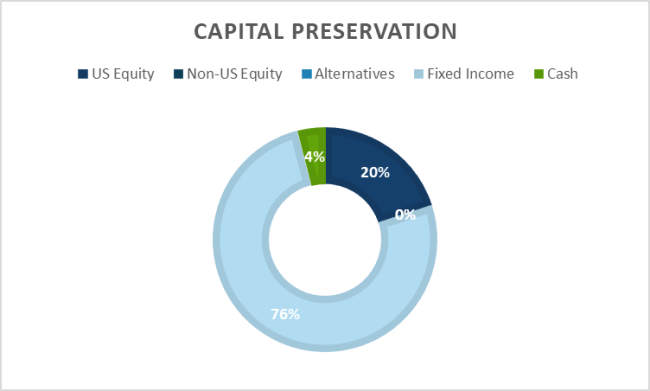

Capital Preservation Portfolio

Our Capital Preservation Model is for clients with a very low risk tolerance and have less than 5 years of time horizon. Emphasis is placed on short-mid duration bond allocations that provide for the safest ways to receive income and stability of account value. Capital Preservation strategies may have up to 20% exposure to US Equities, International Equity, Alternatives and Cash.

Our Platforms

We have two sophisticated, proprietary platforms that are designed with the goal of meeting the needs of our clients, regardless of their stage of investing.

First, you talk to your Advisor or one of our other Investment Professionals to determine what investment platforms would best meet your needs. Together, we’ll work with you to help determine the best course of action.

By using our Model Wealth Portfolios platform, your advisor can spend more time on you—more time looking at your situation, needs, and goals and providing you with the services you want and need to potentially reach those goals.

Learn More

GWP is our Online Advisor-Based Platforms that let’s you sit in the driver’s seat seat of getting started while we work in the background to build a portfolio that meets your needs. Unlike other online investment platforms, with GWP you get the benefit of having an Advisor and Team to Support you when you have questions regarding your accounts or other financial planning needs!

Learn More

What if I want to be able to direct trades, keep certain stocks and personal holdings? Talk to your Advisor to discuss your options. As Independent Financial Advisors, your Advisor has the tools that you need to best meet your needs!

Why we built Models to debunk the Myth of “Custom”

The word “Customized” has become yet another piece of financial jargon in today’s financial landscape. Everyone is using “Custom Portfolio’s” to meet your unique needs, but there is a lot more explanation that we believe needs to come with that term and we are going to boil it down simply in the next sentence. Custom should come in the allocation of a portfolio and not in the specific funds that you or your advisor uses.

Here’s a quick case study to explain our point:

If your advisor has 100 clients (this is pretty average, if not low) and that advisor builds a custom portfolio with unique investments inside of each one. Let’s say each portfolio has 10 unique positions. That’s 100 different portfolios and 1,000 different positions that said advisor has to manage, track, and rebalance at a time. It’s not sustainable and most importantly, it’s not in your best interest!

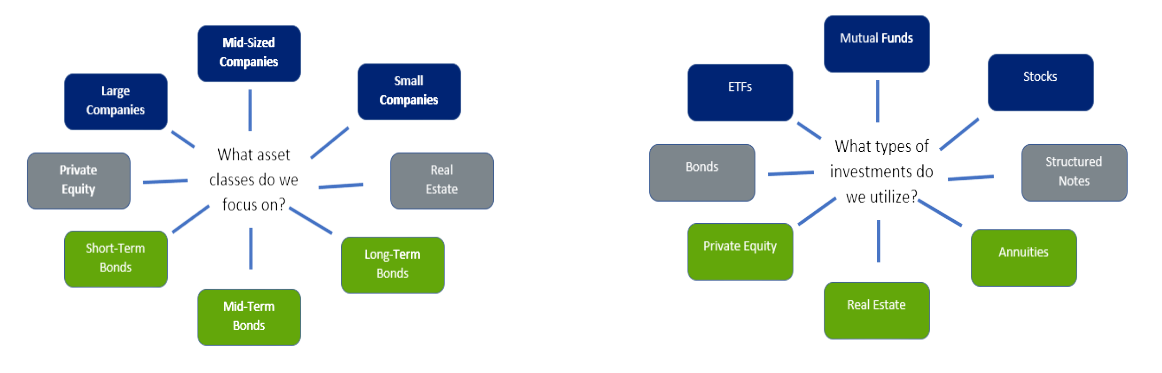

Our strategist Don Clark does it differently. We build Models with a focus on finding the best funds available within each asset class, whether its equities, bonds, real estate, or private equity, and adjust the allocations to those funds based off your needs. This allows us to become hyper-focused on a smaller amount of funds, so we have more time we can spend planning with you.

Get Started

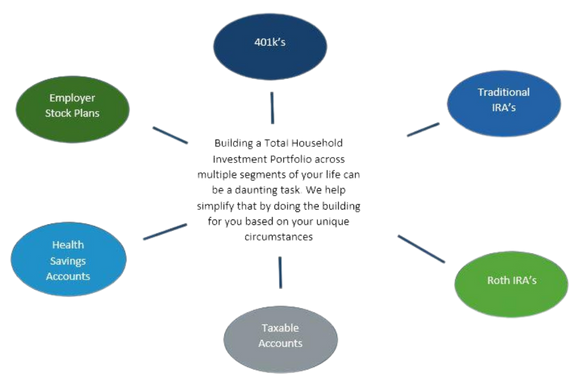

How do I know what I need?

- We always start with your Financial Plan. You cannot build out a Household Investment Strategy without understanding your family’s Cash Flow, Tax Situation, Time to Retirement, Life Expectancy, and overall Goals.

-

Then we discuss both your capacity and your tolerance for risk. Your Risk Capacity will tell us how much risk is possible within your Financial Plan. Your Risk Tolerance will tell us how much risk you can mentally handle.

-

Once we understand your Personal Situation, it’s time to implement a strategy. As Independent Advisors we have unlimited resources at our disposal when it comes to investment options and third-party help.

-

We have full access to the best Mutual Funds & ETFs in the space and take an immense amount of time researching, screening, and monitoring the performance of the funds in our models

-

Because of the size of our firm, we have the ability to leverage and communicate with some of the best asset managers in the world to receive research & analysis on the funds we use and on the overall markets to keep us up to date on what’s driving performance in the past, present, and future