How does the MLB 401k Work?

When it comes to 401k plans and getting a big employer match, there really is no other plan like the MLB plan, even in comparison to other sports leagues.

Let’s focus on the mechanics of the MLB Plan in relation to 2024 rules for this post.

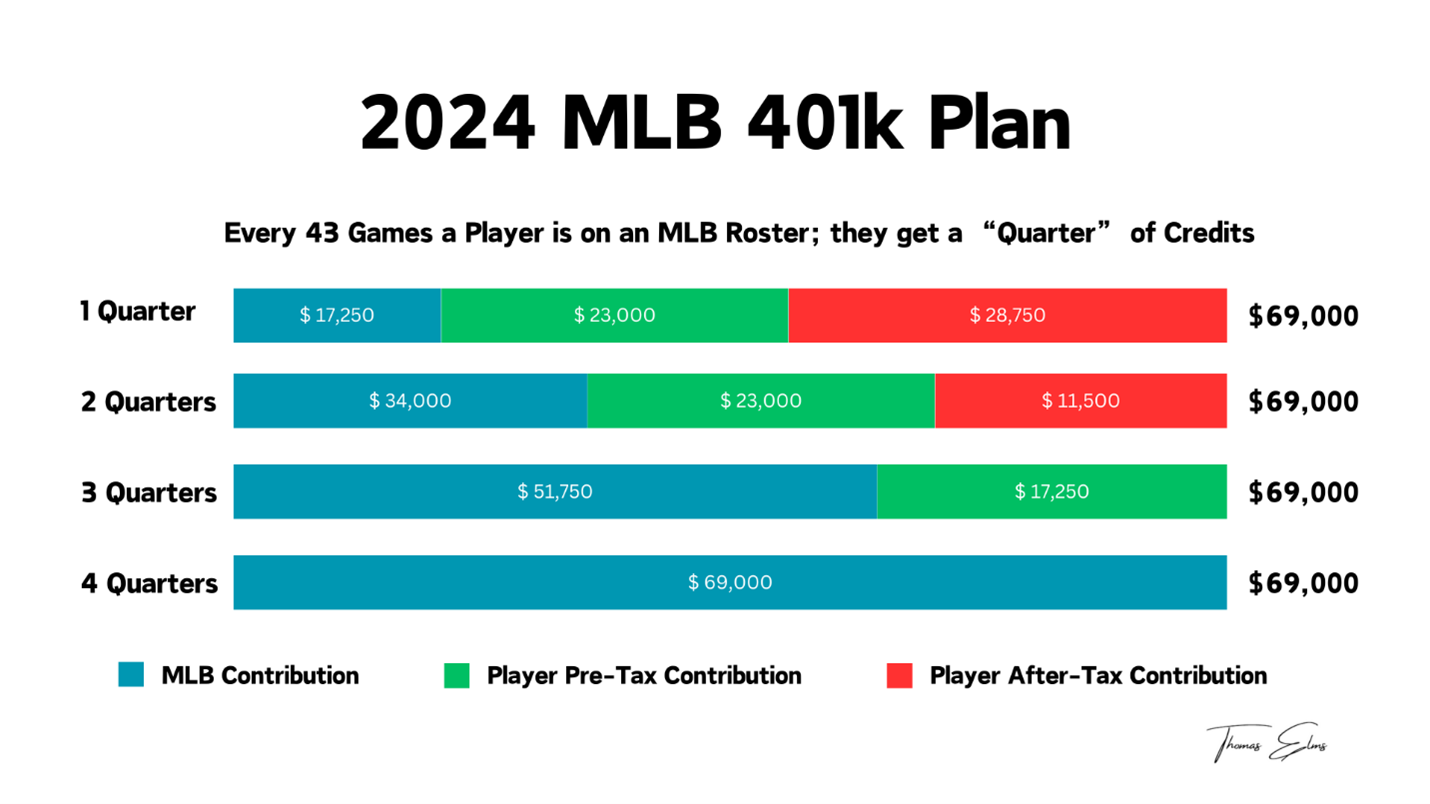

In 2024, the MLB will contribute $17,250 for every "Quarter" that a player is on an MLB Roster (not Minor Leagues).

This money will go into the player’s Pre-Tax Account.

The MLB Season is 162 Games (172 Days) - Each Quarter is 43 Days

Here's my problem with this year’s setup:

The players may not get to maximize their own personal tax situation because they are getting “too much” of an employer match.

I know, what a horrible problem to have. My company gives me too much free retirement money.

But here’s the thing:

If a player is in the MLB for the whole season, he doesn't get to make:

- Pre-Tax Contributions to lower his taxable income

- After-Tax Contributions to convert to Roth for Tax Free Retirement Assets

Not being able to leverage these 2 things as a player is a huge deal

- Their incomes are incredibly high (need tax deductions)

- The average career is short so they need to maximize every year as much as possible.

The worst part?

MLB Contributions for each credited quarter don't get made until normally December.

So players basically have 2 options:

1) Play the guessing game on contributions based on how many quarters they think they'll be in the MLB for

2) Make the max contribution regardless and deal with it later

Either way, if a players 401k "exceeds" the $69,000 max for 2024 between their contributions and the MLB's match, the excess is refunded back to the player.

The player is on the hook to pay costs for the refund and may have tax reporting complications.

For reference, the MLB Salary Minimum is $740,00 for 2024, so every player should be maxing out their 401k as much as possible.

Below is a chart that analyzes the Per Quarter Contributions the MLB will make to a players 401k account based on the number of quarters they are on an MLB Roster, and the maximum respective contributions a player can make themselves on a pre-tax or after-tax basis.

Source: MLB Collective Bargaining Agreement 2024