Weekly Economic Update: December 14th, 2020

In this week’s recap: Rising number of COVID-19 cases and no progress on a stimulus bill lead to a bumpy week on Wall Street; U.K. anticipates “No-Deal” for Brexit.

THE WEEK ON WALL STREET

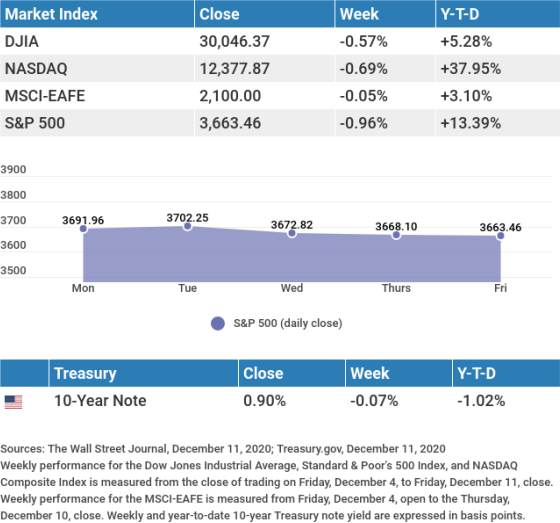

Stocks retreated last week on rising COVID-19 infections and slow progress on an economic relief bill.

The Dow Jones Industrial Average dipped 0.57%, while the Standard & Poor’s 500 dropped 0.96%. The Nasdaq Composite index fell 0.69% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, declined 0.05%.1,2,3

STIMULUS STALLS, STOCKS STUMBLE

The market grappled all week with worries over rising COVID-19 cases and the economic restrictions that followed. Nevertheless, there were moments of optimism— such as the starting of vaccinations in the U.K.— that drove markets to record highs.4

But gains could not be sustained as an agreement on a fiscal stimulus bill remained elusive and daily news regarding COVID-19 cases undermined investor sentiment.

Markets were also challenged by having to absorb a number of new and secondary stock offerings last week, including two high-profile technology IPOs. The Energy sector continued its strong run, while small and mid-cap stocks posted another week of positive performance.5

A “NO-DEAL” BREXIT MORE LIKELY

The prospects of an agreement to manage Britain’s exit from the European Union by year end dimmed as the two parties failed to narrow their differences in a meeting held last week.6

Though primarily a European issue, a no-deal Brexit may hold consequences for U.S. businesses and investors. The failure to reach an agreement has the potential to disrupt an already fragile supply chain and cause issues in the financial markets. A supply chain disruption may weaken European economies (e.g., Germany) that are important to American companies. Another consequence may be a stronger U.S. dollar, which would make American exports more expensive and less competitive.

Little time remains in striking an agreement since the prevailing framework ends December 31, 2020.

T I P O F T H E W E E K

Starting a small business? A written plan is handy for forecasting, budgeting and presenting your idea to potential investors. A written plan is far preferable to one you keep in your head.

THE WEEK AHEAD: KEY ECONOMIC DATA

Tuesday: Industrial Production.

Wednesday: Retail Sales, Federal Open Market Committee (FOMC) Announcement.

Thursday: Housing Starts, Jobless Claims.

Friday: Index of Leading Economic Indicators.

Source: Econoday, December 11, 2020 The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Thursday: General Mills (GIS).

Friday: Darden Restaurants (DRI).

Source: Zacks, December 11, 2020 Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.Q U O T E O F T H E W E E K

“You’re born an original. Don’t die a copy.”

JOHN MASON

THE WEEKLY RIDDLE

At a class reunion, everyone shakes hands exactly once with every person present. That results in a total of 28 handshakes. In total, how many people are at the reunion?

LAST WEEK’S RIDDLE: I have keys that will open no locks. I have a space and a lock that’s a key. You can enter but you can’t leave, and yet - you can escape. What am I? ANSWER: A keyboard.Securities offered through LPL Financial, Member FINRA/SIPC. Investment Advice offered through Personal Financial Group, Inc. a registered investment advisor and separate entity from LPL Financial. The information contained in this e-mail message is being transmitted to and is intended for the use of only the individual(s) to whom it is addressed. If the reader of this message is not the intended recipient, you are hereby advised that any dissemination, distribution or copying of this message is strictly prohibited. If you have received this message in error, please immediately delete.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note - investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested.

This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such.

All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

CITATIONS:

- The Wall Street Journal, December 11, 2020

- The Wall Street Journal, December 11, 2020

- The Wall Street Journal, December 11, 2020

- USAToday.com, December 8, 2020

- CNBC.com, December 10, 2020

- CNBC.com, December 9, 2020