Weekly Economic Update: June 28th, 2021

In this week’s recap: Stocks reach all-time highs and the housing market showed significant improvement.

THE WEEK ON WALL STREET

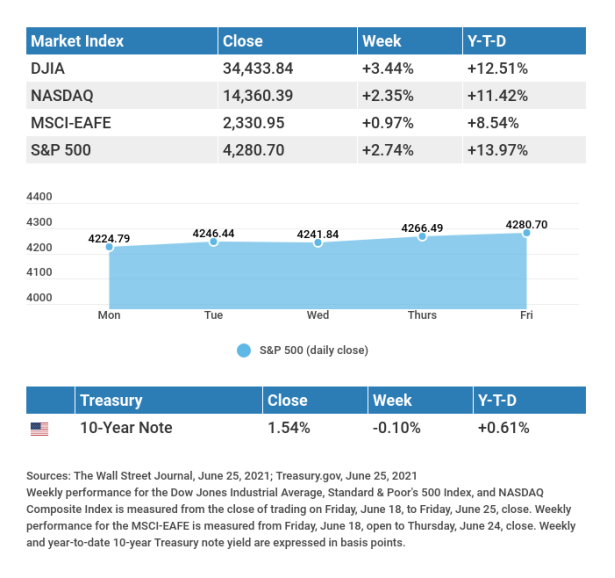

Stocks reached new all-time highs last week as markets staged a strong rebound from the previous week’s declines.

The Dow Jones Industrial Average rose 3.44%, while the Standard & Poor’s 500 picked up 2.74%. The Nasdaq Composite index increased 2.35%. The MSCI EAFE index, which tracks developed overseas stock markets, gained 0.97%. 1,2,3

STOCKS CLIMB

Stocks rallied on the first day of trading last week and gained further momentum on Thursday and Friday. Despite some discouraging data on housing and initial jobless claims, stocks managed to set new highs, as investors cheered an agreement between President Biden and a group of senators that appeared to pave the way for the passage of a $1 trillion infrastructure bill. 4

Positive results from the Federal Reserve’s stress tests of banks, which raised the prospect of banks raising their dividend payouts and share buybacks, and a key inflation measure coming in at market expectations provided impetus for further gains. The S&P 500 had its best week since February and ended the five-trading days at a record high. 5

HOUSING HEADWINDS

Historically low mortgage rates, the COVID-19 pandemic, and a flush consumer have contributed to a very strong housing market in recent months. Last week’s housing data for May, however, showed that housing may be running into headwinds. The rising cost of materials and labor led to a 5.9% decline in new single home sales in May even as the median price hit an all-time high. 6 Meanwhile, sales of existing homes fell 0.9%, the fourth-straight month of declines, owing to a very low inventory. High demand, coupled with a depressed supply, led to a 23.6% increase in the median price of an existing home. 7

T I P O F T H E W E E K

Double-check that your legal documents (your will, power of attorney, and trusts) are appropriately titled.

THE WEEK AHEAD: KEY ECONOMIC DATA

Tuesday: Consumer Confidence.

Wednesday: ADP (Automated Data Processing) Employment Report.

Thursday: Jobless Claims. ISM (Institute of Supply Management) Manufacturing Index.

Friday: Employment Situation Report. Factory Orders.

Source: Econoday, June 25, 2021 The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Wednesday: Micron Technology, Inc. (MU), Constellation Brands, Inc. (STZ), General Mills, Inc. (GIS).

Thursday: Walgreens Boots Alliance, Inc. (WBA), McCormick & Company, Inc. (MKC).

Source: Zacks, June 25, 2021 Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.Q U O T E O F T H E W E E K

“Lasting change is a series of compromises. And compromise is all right, as long your values don't change.”

JANE GOODALL

THE WEEKLY RIDDLE

Can you write down eight eights so that they add up to one thousand?

LAST WEEK’S RIDDLE: Before Mt. Everest was measured, in 1819, what was the highest mountain on earth?

ANSWER: Mt. Everest was the highest - it simply hadn't been measured yet.

Securities offered through LPL Financial, Member FINRA/SIPC. Investment Advice offered through Personal Financial Group, Inc. a registered investment advisor and separate entity from LPL Financial. The information contained in this e-mail message is being transmitted to and is intended for the use of only the individual(s) to whom it is addressed. If the reader of this message is not the intended recipient, you are hereby advised that any dissemination, distribution or copying of this message is strictly prohibited. If you have received this message in error, please immediately delete.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note - investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested.

This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such.

All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Copyright 2021 FMG Suite.

CITATIONS:

1. The Wall Street Journal, June 25, 2021

2. The Wall Street Journal, June 25, 2021

3. The Wall Street Journal, June 25, 2021

4. CNBC, June 23, 2021

5. CNBC, June 23, 2021

6. Fox Business, June 23, 2021

7. CNBC, June 22, 2021