Weekly Economic Update: March 1st, 2021

In this week’s recap: Rising bond yields deliver a blow to stocks; Fed Chair affirms commitment to current money policy.

THE WEEK ON WALL STREET

Stocks dropped amid rising long-term bond yields, with sharp declines in high-valuation growth stocks leading the overall market lower.

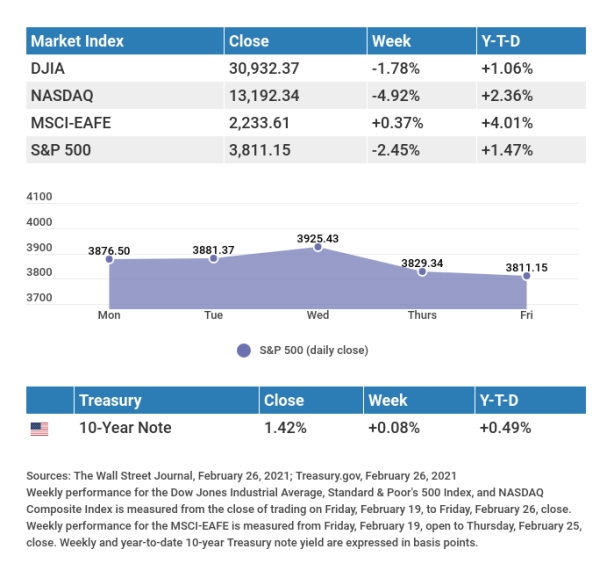

The Dow Jones Industrial Average slipped 1.78%, while the Standard & Poor’s 500 declined 2.45%. The Nasdaq Composite index, home to many high-valuation growth plays, fell 4.92% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, edged up 0.37%. 1,2,3

RISING RATES DERAIL STOCKS

The 10-year Treasury yield climbed last week, from 1.34% to 1.42%, sending shudders through the stock market. While investors generally understand that economic strength may lead to higher bond yields, it was the speed at which bond yields rose that proved unsettling. Generally, when yields rise, bond prices tend to fall. 4

Rising yields also drove sector rotation, with economic reopening stocks (e.g., energy, financials, and industrials) outperforming stay-at-home stocks, especially many of the big technology names.

The trend of higher yields was mitigated by testimony on Tuesday and Wednesday by Fed Chair Jerome Powell. He provided some assurances that the Fed remained committed to its current easy money policy stance. 5

A surge in yields on Thursday, however, sparked a new wave of anxiety and a broad retreat that left market averages lower for the week.

POWELL TESTIMONY CALMS INVESTORS

Concerns over rising long-term bond yields and inflationary pressures were eased by two days of testimony by Fed Chair Powell. Powell reiterated the Fed’s intention to stick with its near-zero short-term interest rate policy and monthly bond purchase program until the labor market fully recovers and its inflation goals are met.

Powell dismissed market fears of accelerating inflation, noting that he did not see inflation reaching any troubling levels, declaring that any increase would be modest and transitory. He added that the Fed would likely allow inflation to spend some time above its 2% target rate. Inflation for the past eight years straight has been below that target. 5

T I P O F T H E W E E K

If marriage gives you a new last name, be sure to notify Social Security, your bank, and the investment and insurance companies with whom you have accounts and policies about the name change.

THE WEEK AHEAD: KEY ECONOMIC DATA

Monday: Institute for Supply Management (ISM) Manufacturing Index.

Wednesday: Automated Data Processing (ADP) Employment Report. Institute for Supply Management (ISM) Services Index.

Thursday: Jobless Claims. Factory Orders.

Friday: Employment Situation Report.

Source: Econoday, February 26, 2021 The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Monday: Zoom Video Communications, Inc. (ZM).

Tuesday: Target (TGT), Ross Stores, Inc. (ROST).

Wednesday: Okta, Inc. (OKTA), Marvell Technology Group (MRVL), Dollar Tree, Inc. (DLTR).

Thursday: Broadcom, Inc. (AVGO), Costco Wholesale Corp. (COST), Kroger (KR).

Source: Zacks, February 26, 2021 Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.Q U O T E O F T H E W E E K

“Chance favors only the prepared mind.”

LOUIS PASTEUR

THE WEEKLY RIDDLE

A woman walking along a canal sees a boat full of people, yet there isn't a single person on board. How could this be?

LAST WEEK’S RIDDLE: What appears once in a minute, twice in a moment, but never in a decade? ANSWER: The letter M.

Securities offered through LPL Financial, Member FINRA/SIPC. Investment Advice offered through Personal Financial Group, Inc. a registered investment advisor and separate entity from LPL Financial. The information contained in this e-mail message is being transmitted to and is intended for the use of only the individual(s) to whom it is addressed. If the reader of this message is not the intended recipient, you are hereby advised that any dissemination, distribution or copying of this message is strictly prohibited. If you have received this message in error, please immediately delete.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note - investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested.

This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such.

All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Copyright 2021 FMG Suite.

CITATIONS:

1. The Wall Street Journal, February 26, 2021

2. The Wall Street Journal, February 26, 2021

3. The Wall Street Journal, February 26, 2021

4. U.S. Department of the Treasury, February 26, 2021

5. The Wall Street Journal, February 24, 2021