Weekly Economic Update: March 8th, 2021

In this week’s recap: Stocks have a mixed reaction to rising bond yields and increasing inflation.

THE WEEK ON WALL STREET

Stocks were mixed last week as rising bond yields and heightening inflation fears sent stocks on a wild ride, capped by a remarkable Friday afternoon rally.

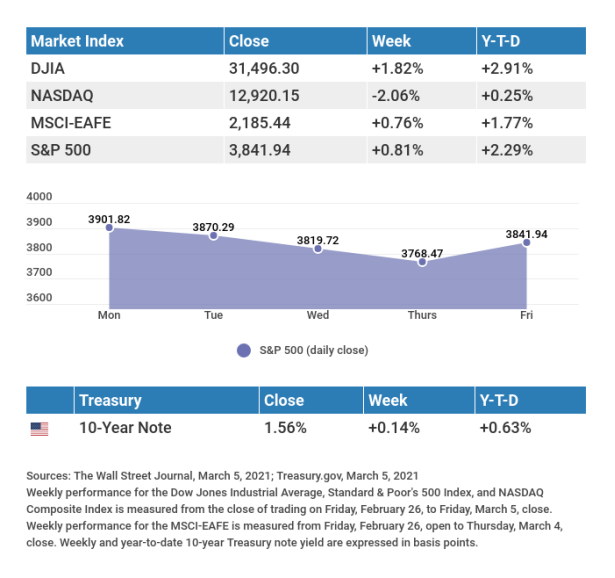

The Dow Jones Industrial Average gained 1.82%, while the Standard & Poor’s 500 increased by 0.81%. The Nasdaq Composite index fell 2.06% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, rose 0.76%. 1,2,3

RISING RATES WHIPSAW STOCKS

The week began on an ebullient note as stocks surged on a retreat in bond yields and approval of a new vaccine, with sharp gains in reopening stocks, hard-hit technology companies, and small-cap companies.

But the optimism proved fleeting as worries over rising bond yields upended the high valuation growth stocks and sent the broader market lower. Deteriorating investor sentiment culminated in a steep sell-off on Thursday, sparked by comments from Fed Chair Jerome Powell that did little to allay investors’ concerns about rising yields and festering inflation anxieties. 4

Stock prices rallied on a strong employment report on Friday, but some of the enthusiasm was tempered by rising yields.

U.S. DOLLAR'S SURPRISING STRENGTH

Last week, the U.S dollar gained 0.93% against a basket of international currencies—a relatively big move in the currency market. Year-to-date the dollar has appreciated over 2%. 5

U.S. dollar strength this year has defied the expectations of many analysts who anticipated that a global economic recovery would prompt a shift away from the safe harbor of the dollar toward non-dollar denominated assets.

However, rising U.S. yields and a faltering economic rebound in Europe have instead propelled the U.S. dollar higher, raising concerns about tight financial conditions abroad and its potential adverse impact on an emerging markets recovery.

T I P O F T H E W E E K

New parents can sometimes spend a little too much on cute and trendy stuff. Here’s a test: will the item improve the quality of care for your baby? If not, leave it at the store.

THE WEEK AHEAD: KEY ECONOMIC DATA

Wednesday: Consumer Price Index (CPI).

Thursday: Jobless Claims. Job Openings and Labor Turnover Survey (JOLTS).

Friday: Consumer Sentiment.

Source: Econoday, March 5, 2021 The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Wednesday: Campbell Soup Company (CPB).

Thursday: JD.com (JD), Ulta Beauty, Inc. (ULTA), Docusign (DOCU), GoodRx Holdings (GDRX).

Source: Zacks, March 5, 2021 Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.Q U O T E O F T H E W E E K

“Pleasure may come from illusion, but happiness can come only of reality.”

SEBASTIEN-ROCH NICOLAS DE CHAMFORT

THE WEEKLY RIDDLE

The name of a particular insect is six letters long. You can lop off the last three letters from its name and end up with the name of another insect. What is this six-letter word?

LAST WEEK’S RIDDLE: A woman walking along a canal sees a boat full of people, yet there isn't a single person on board. How could this be? ANSWER: Everyone on board is married or partnered (not single).

Securities offered through LPL Financial, Member FINRA/SIPC. Investment Advice offered through Personal Financial Group, Inc. a registered investment advisor and separate entity from LPL Financial. The information contained in this e-mail message is being transmitted to and is intended for the use of only the individual(s) to whom it is addressed. If the reader of this message is not the intended recipient, you are hereby advised that any dissemination, distribution or copying of this message is strictly prohibited. If you have received this message in error, please immediately delete.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note - investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested.

This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such.

All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Copyright 2021 FMG Suite.

CITATIONS:

1. The Wall Street Journal, March 5, 2021

2. The Wall Street Journal, March 5, 2021

3. The Wall Street Journal, March 5, 2021

4. The Wall Street Journal, March 4, 2021

5. The Wall Street Journal, March 5, 2021