What Makes Guided Wealth Portfolios Different?

While other digital investing solutions offer online investment management, most don’t include a direct personal relationship with a dedicated financial advisor. With GWP, we’ll be your personal team, dedicated to you and your goals, helping to guide you through the investing process.

Powering Your Future with a Personal Touch

Our unique online platform, Guided Wealth Portfolios, combines the benefits of a personal financial advisor with sophisticated technology.

Get Started

sell

AUTOMATIC

COST EFFECTIVE

24/7 ACCESS

Our model portfolios are designed to be a part of a long-term investing plan that helps meet your needs during each stage of your life.

change_circle

STRATEGIC

RISK MANAGED

PROFESSIONAL ETF ANALYSIS

Active ETF portfolio management and rebalancing for investors of all ages and risk tolerances.

hail

PERSONALIZED

LEADERSHIP

EXPERIENCE

OpuVest's experienced investment committee has over 15 years of experience in custom, personal financial planning to guide you towards reaching your financial goals.

How It Works

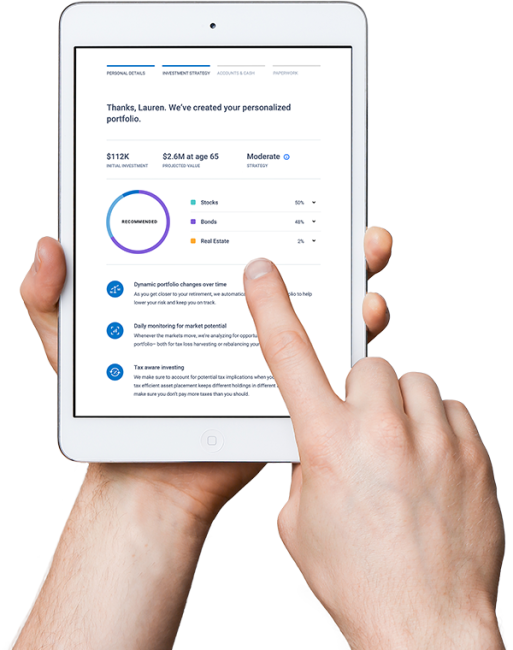

We will let you complete our brief and simple questionnaire. This will help us know more about your current investment experience, your timeline and risk tolerance. Our expert Advisers use smart, sophisticated technology, research and analytic tools to analyze your current situation and then recommend the most effective and strategic investment plan that is truly tailored your goals.

Get Started

What We Offer

Personalized Service & Advice

The path to your financial goals is personalized for your specific stage in life, and will change as your life changes. If your goals change or you ever have any questions, your advisor is only an email or phone call away.

Convenient, Intelligent Technology

You can always view your account's activity, track account performance, and update your individual plan, all in your personalized online portal. If you have any questions, our service team is available.

Advanced Investment Strategies at a Low Cost

We can implement your personal roadmap using proven investment techniques while keeping your costs low. Receive diversified allocations designed for you and your savings goals, and benefit from trading techniques that may increase diversification and can help reduce taxes.

Through daily monitoring and advanced trading techniques, we work to reduce your taxes and improve your portfolio.

Get Back To Your Life

Your Portfolio is monitored daily and periodically rebalanced and optimized so that it remains aligned with your investment strategy.

If you're looking for a solution that gives you access to a Financial Advisor when you need it, but prefer a streamlined process that allows you to update your plan without unnecessary meetings, this platform is for you!

Your financial future is up to you and planning for your retirement today is more important than ever.

Longer life spans, rising costs, and questions surrounding the future financial solvency of Social Security may mean that the bulk of your retirement income will need to come from personal savings. Unlike our parents and grandparents, we may not be able to rely on Social Security and pension plans to provide us with the financial means necessary to live comfortably throughout retirement.

Ready to take the next step to improve your investments?

Get Started

About Guided Wealth Portfolio

GWP is our Online Advisor-Based Platforms that let’s you sit in the driver’s seat in the driver’s seat of getting started while we work in the background to build a portfolio that meets your needs. Unlike other online investment platforms, with GWP you get the benefit of having an Advisor and Team to Support you when you have questions regarding your accounts or other financial planning needs!

- Self-Guided Online Platform

- Minimum Investment - $5,000.

- Exchange-Traded Products (ETFs) to keep costs low

- Fully Managed through the Portfolio Strategist

- Advisor Available for Additional Financial Planning

Guided Wealth Portfolios (GWP) is an investment advisory program sponsored by LPL Financial LLC (LPL), an SEC registered investment adviser and member FINRA/SIPC, and subadvised by FutureAdvisor, an SEC registered investment adviser. GWP uses proprietary, automated, computer algorithms of FutureAdvisor to generate investment recommendations based upon model portfolios constructed by LPL. SEC registration does not constitute an endorsement of the firm by the SEC and does not imply a certain level of skill or training. Securities offered by LPL. FutureAdvisor and LPL are non-affiliated entities. If you are receiving advisory services in GWP from a separately registered investment advisor firm other than LPL or FutureAdvisor, LPL and FutureAdvisor are not affiliates of such advisor.

Please see the Methodology and Assumptions used in GWP.

IMPORTANT: The projections or other information generated by GWP regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Results may vary with each use and over time.

Investing involves risk, including possible loss of principal.

Past performance is not indicative of future results. The Educational Tool provides access to “free” sample recommendations at no charge to you. However, if you decide to implement sample recommendations by executing trades with another firm, you may be charged fees, commissions, or expenses by that firm, as well as underlying investment fund fees and expenses. If you decide to open a Managed Service account, you will be charged a quarterly account fee, as well as additional fees and expenses. The tax loss harvesting and other tax strategies discussed should not be interpreted as tax advice and there is no representation that such strategies will result in any particular tax consequence. Clients should consult with their personal tax advisors regarding the tax consequences of investing.